Loading

Get Sentry 401k Withdrawal Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sentry 401k Withdrawal Form online

Completing the Sentry 401k Withdrawal Form online is a straightforward process designed to assist users in managing their retirement funds efficiently. This guide provides clear, step-by-step instructions to help navigate through each section of the form with ease.

Follow the steps to complete the Sentry 401k Withdrawal Form online.

- Press the ‘Get Form’ button to access the Sentry 401k Withdrawal Form and open it in the editing interface.

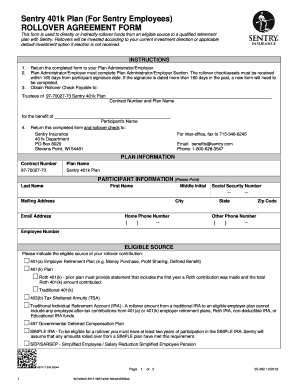

- Begin by filling out the participant information section. Input your last name, first name, middle initial, mailing address, city, state, zip code, email address, and both home and other phone numbers.

- Next, provide your Social Security number and employee number in the designated fields.

- Indicate your eligible source for the rollover contribution by selecting the appropriate option from the list provided. Ensure that any necessary supporting documentation is available, especially if you are rolling over funds from a Roth 401(k).

- In the participant authorization section, read the statements carefully. Then, print your name, date, and include your signature to confirm your understanding and authorization for the rollover process.

- Complete the plan administrator approval section, which requires verification from your plan's administrator. Ensure they print their name, sign, and date the form.

- Finally, review all entries for accuracy, then proceed to save your changes, download the filled form, print it, or share it as necessary.

Complete your Sentry 401k Withdrawal Form online today to manage your retirement funds effectively.

To make a 401(k) hardship withdrawal, you will need to contact your employer and plan administrator and request the withdrawal. The administrator will likely require you to provide evidence of the hardship, such as medical bills or a notice of eviction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.