Loading

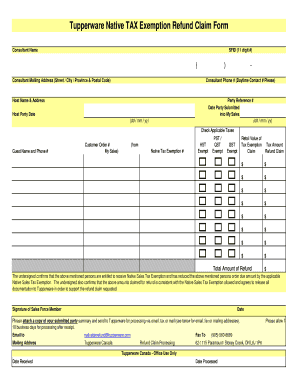

Get Tupperware Native Tax Exemption Refund Claim Form En ... - Superb1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tupperware Native Tax Exemption Refund Claim Form online

This guide provides a step-by-step approach to completing the Tupperware Native Tax Exemption Refund Claim Form. Designed to assist users in accurately filling out the form, this resource aims to simplify the online process.

Follow the steps to successfully complete your refund claim.

- Click the 'Get Form' button to access the Tupperware Native Tax Exemption Refund Claim Form. This will open the form in your preferred online editor.

- In the first section, fill in your full name as the consultant, along with your 11-digit SFID number in the designated field.

- Provide your mailing address, ensuring to include the street, city, province, and postal code accurately.

- Enter your daytime contact phone number for effective communication during the processing of your claim.

- Next, input the host's name and address, which is necessary for the details of the party referenced in the claim.

- Fill in the party reference number and the date the party was submitted into your sales record, formatted as day/month/year.

- Document the host party date, also in the day/month/year format.

- Check the applicable taxes that apply, such as HST, PST/QST, and GST exemptions by marking the corresponding boxes.

- Input the guest's name and contact number to maintain clear communication related to the claim.

- Record the customer order number as it pertains to your sales transaction.

- List the Native Tax Exemption number that is applicable for your claim in the specified field.

- Enter the retail value of the tax exemption claim and the corresponding tax amounts for HST, PST/QST, and GST in the appropriate sections.

- Calculate and input the total amount of refund you are claiming at the bottom of the form.

- Sign and date the form, confirming the accuracy of your claims and that you are entitled to the exemption.

- Attach a copy of your submitted party summary and submit the completed form to Tupperware via email, fax, or mail as instructed in the document.

- After submission, please allow for a processing time of up to 10 business days.

- Finally, save any changes, download a copy, print for your records, or share the form as needed.

Complete your refund claim online today!

Log in with your username and password on our website at onlineservices.cdtfa.ca.gov. Click on the account for which you want to request a refund, and select the More link under the I Want To section. Then select the Submit a Claim for Refund link, and follow the prompts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.