Loading

Get Input Data Sheet For The Online Application For The P F Code Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

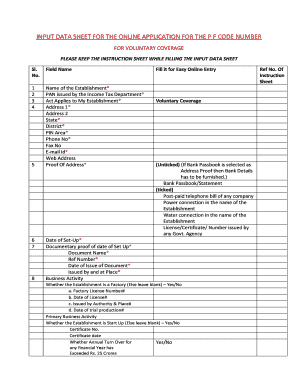

How to fill out the INPUT DATA SHEET FOR THE ONLINE APPLICATION FOR THE P F CODE NUMBER online

Filling out the INPUT DATA SHEET for the online application for the P F code number can seem daunting, but this guide will assist you in completing each section efficiently. Follow the step-by-step instructions for a seamless online submission process.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to obtain the form and open it for entry.

- Enter the name of the establishment in the designated field, ensuring it reflects the registered name.

- Provide the PAN issued by the Income Tax Department in the required field. Ensure it is accurate to avoid discrepancies.

- Indicate which act applies to your establishment, selecting the relevant option from the dropdown or checkbox provided.

- Fill in the address details, starting with Address 1, and complete Address 2 if necessary. Include your state and district, then the PIN area for precise location identification.

- Supply your contact information, including phone number and e-mail address, to facilitate communication. You may also include details of the web address if available.

- Select your proof of address from the given options. If Bank Passbook is selected, you will need to provide additional bank details.

- Fill in the date of set-up of the establishment and attach the requisite documentary proof. Provide document name, reference number, and date of issue.

- Specify if the establishment is a factory, and if so, provide the factory license number and associated details.

- Indicate whether your establishment is a start-up and provide the relevant certificate details if applicable.

- State whether the annual turnover has exceeded Rs. 25 crores for the specified financial year.

- Respond to whether the establishment is covered under the ESIC act and provide the ESIC number if applicable.

- Provide ownership details, including ownership type, registration number, date of registration, and particulars of owners.

- If the establishment is leased, fill in the lease details including the leasing period and information about the lessee.

- Provide employee details, including the total number of employees and details of excluded employees.

- Fill in the bank details including IFSC code, bank name, branch name, account number, and account type.

- Specify whether the establishment has one or several units and provide details for each branch if applicable.

- Upload required documents including PAN, proof of address, date of establishment, licenses, and specimen signature as needed.

- Review all the information entered for accuracy, then proceed to save changes, download, print, or share the completed form.

Complete all required fields and submit your application online today!

The Universal Account Number or UAN is a 12-digit unique number assigned to every employee contributing to the EPF. It is generated and allotted by the Employees' Provident Fund Organisation (EPFO) and authenticated by the Ministry of Labour and Employment, Government of India.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.