Loading

Get Form 2643a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2643a online

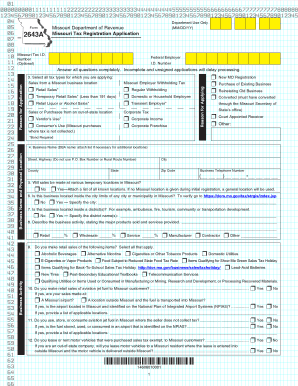

Filling out the Form 2643a online is an essential step for individuals or businesses registering for taxes in Missouri. This guide provides clear instructions to help users navigate each component of the form effectively.

Follow the steps to fill out the Form 2643a online successfully.

- Press the ‘Get Form’ button to access the Form 2643a and open it in the designated editor.

- Begin by entering your Missouri Tax I.D. Number, if you have one, and the Federal Employer I.D. Number in the provided fields.

- Select all applicable tax types you are applying for by checking the corresponding boxes, such as sales from a Missouri business location or corporate tax.

- Indicate the reason for applying by selecting one of the options available, such as new MO registration or purchase of an existing business.

- Provide your business name and physical location details, ensuring to include street address, city, county, zip code, and state.

- Answer whether sales will be made at various temporary locations in Missouri by selecting 'Yes' or 'No' and attaching a list if applicable.

- Specify whether your business is located inside the city limits of any municipality in Missouri and provide the name of the city if applicable.

- Indicate if your business is located inside any special district by checking 'Yes' or 'No' and specify the district name(s) if applicable.

- Describe your business activity, including major products sold and services provided in the designated area.

- List all taxable items sold, such as alcoholic beverages or e-cigarettes, by checking the appropriate boxes provided.

- If applicable, indicate whether you sell aviation jet fuel to Missouri customers and provide additional information about the sales locations.

- Fill out the ownership type section, providing required numbers and dates related to your business registration with the Missouri Secretary of State’s Office.

- Enter the owner information, including name, address, email, and social security number, ensuring to specify the business's previous owner, if applicable.

- Provide the mailing and storage address for official correspondence related to your business.

- Identify all individuals responsible for tax matters, including their names and roles within the company.

- Complete the sections regarding taxable sales or purchases, including estimated liability for tax returns and bond calculations.

- Finally, review all entered information for accuracy, save changes, and choose to download, print, or share the completed form as needed.

Complete your filing of Form 2643a online today to ensure timely tax registration!

A Missouri resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.