Loading

Get Farmers Extract Of Accounts Template - Revenue - Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Farmers Extract Of Accounts Template - Revenue - Revenue online

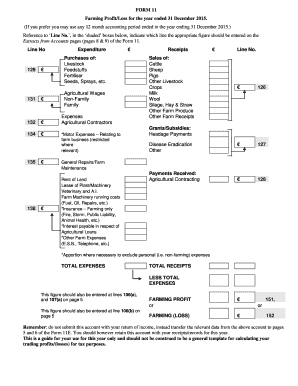

Filling out the Farmers Extract of Accounts Template is an essential task for accurately reporting your farming income and expenses. This guide will provide you with step-by-step instructions to complete the form online with ease, ensuring a thorough understanding of each component required.

Follow the steps to effectively complete the Farmers Extract of Accounts Template online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the line number for each expenditure item listed in the shaded boxes. This includes livestock purchases, feedstuffs, and other agricultural expenses. Make sure to record the corresponding amounts in euros.

- Proceed to the receipts section by indicating the line number for each source of income from your farming operations, such as sales of livestock and crops. Input the figures in euros accurately.

- Calculate the total expenses and total receipts by summing up the individual entries. Ensure that your calculations are accurate to reflect true financial standing.

- Subtract the total expenses from the total receipts to determine your farming profit or loss for the period. Record this figure accurately in the designated line.

- Review all entries to confirm that the information is correct and complete. It’s essential to ensure that no personal (non-farming) expenses are included where indicated.

- Finally, save your changes, and you may download, print, or share the completed form as required for your records.

Start filling out your Farmers Extract of Accounts Template online today to maintain accurate financial records.

Cash basis is the accounting method preferred by most farmers, and farmers account for expenses when they are paid and receivables when payment is received. While cash basis accounting is less precise than accrual accounting, it is much easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.