Loading

Get Rev 757

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 757 online

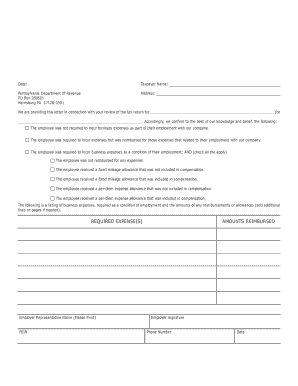

The Rev 757 form is an important document used by employers to certify employee business expenses. This guide will walk you through the process of completing the form online, ensuring you provide all required information accurately and efficiently.

Follow the steps to complete the Rev 757 form online.

- Click the ‘Get Form’ button to obtain the Rev 757 form and open it in the editor for online completion.

- Enter the date when you are completing the letter at the top of the form. This is essential for record-keeping and processing.

- Fill in the taxpayer’s full name and address in the designated fields. Accuracy here is crucial as it identifies the individual related to the business expense certification.

- In the section where the letter states ‘We are providing this letter in connection with your review of the tax return for’, provide the relevant tax return details as necessary.

- Select the appropriate options to confirm whether the employee incurred business expenses, if they were reimbursed, and if so, specify the nature of those reimbursements. Check all applicable boxes.

- List any required business expenses, along with the amounts reimbursed or allowances given. Use additional lines or pages if you need more space to detail the expenses.

- Provide the name of the employer representative who is signing the letter and ensure they print their name clearly.

- The employer must sign the document after it is printed. Ensure that the signature is included as part of the formal submission.

- Fill in the Federal Employer Identification Number (FEIN) in the appropriate field to ensure identification of the employer.

- Include a contact phone number below the signature line for any follow-up or inquiries related to the letter.

- Once all fields are completed and reviewed, you can save the changes to your document, download a copy, or print the form to submit it as required.

Complete your Rev 757 form online today and ensure accurate certification of employee business expenses.

Your annual income as reported on your Form W-2 is called “Taxable Gross Income.” Your income will be less than your salary if you have pre-tax deductions for a 403(b) or other deferred compensation plan, or if you have pre-tax deductions for your elected benefits, such as health and dental insurance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.