Loading

Get Weekly Budget Worksheet Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Weekly Budget Worksheet Pdf online

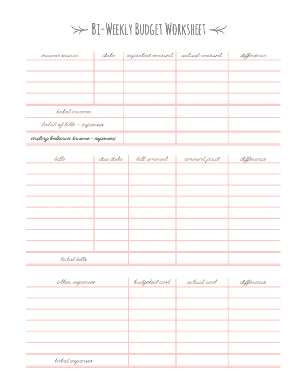

Managing your finances can be made easier with a well-structured budget. The Weekly Budget Worksheet Pdf provides users with a clear way to track income and expenses online, ensuring a comprehensive view of your financial health.

Follow the steps to complete your Weekly Budget Worksheet Pdf online

- Click ‘Get Form’ button to obtain the document and open it in your preferred editor.

- Begin by entering your income sources. In the income source section, list all sources of income along with the corresponding date, expected amount, actual amount, and the difference between expected and actual income.

- Next, move to the bills section. Here, list each bill, its due date, the billed amount, amount paid, and the difference between the billed amount and amount paid.

- In the expenses section, note any other expenses you incur. This includes budgeted cost, actual cost, and the difference between them.

- After filling out all the income and expenses, calculate the total income and the total of bills plus other expenses. Input these totals in the designated fields.

- Finally, determine your ending balance by subtracting total expenses from total income. Ensure all fields are accurate.

- Once you have completed the worksheet, review your entries for accuracy. You can then save changes, download the document, print it, or share it as needed.

Start managing your budget effectively by filling out your Weekly Budget Worksheet Pdf online today.

How much of my biweekly paycheck should I save? As a general rule, you should aim to save at least 20% of your take-home income each paycheck. For example, if you're following the 50/30/20 budget rule, this means you'll want to set aside: 50% of your paycheck to put towards your needs (living essentials)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.