Loading

Get Example - Payroll Services Llc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Example - Payroll Services LLC online

This guide provides an overview of the steps necessary to fill out the Example - Payroll Services LLC form online. By following these instructions, users can ensure accurate completion of this essential document.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to obtain the form and access it in your preferred digital editor.

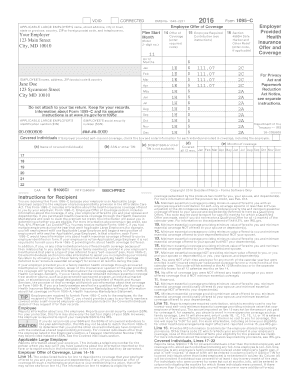

- Begin by entering your employer's information, including their name, address, city, state, and the employer identification number (EIN). This information is vital for identification purposes.

- Next, input your personal details such as your name, address, and social security number (SSN). Be sure to confirm that the information matches your official documents.

- For the sections labeled Offer of Coverage, indicate the type of coverage you received from your employer by using the relevant codes provided in the instructions.

- Continue by completing the lines for employee required contribution, detailing the monthly cost for the lowest-cost single coverage offered to you.

- In the Covered Individuals section, list any dependents covered by your employer's health plan. Enter their names, SSNs, and indicate the months they were covered.

- Finally, review all entered information for accuracy. Once everything is confirmed, you can save your changes, download, print, or share the form as needed.

Complete your documents online with confidence and efficiency!

QuickBooks earns our nod for the easiest setup because its user interface is so intuitive for anyone familiar with QuickBooks. In addition to customer service, there are ample resources online to get anyone on board with their payroll services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.