Loading

Get Sip Jhrps

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sip Jhrps online

This guide provides clear and detailed instructions for completing the Sip Jhrps online form. By following these steps, you will be able to successfully submit your contributions for your Plan account.

Follow the steps to fill out the form online

- Press the ‘Get Form’ button to access the online version of the Sip Jhrps form.

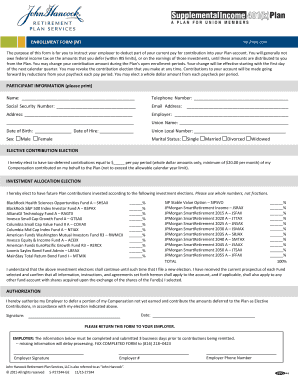

- Begin by entering your participant information. Fill in your name, telephone number, social security number, email address, address, employer name, union name, date of birth, date of hire, union local number, and indicate your sex and marital status.

- For the elective contribution election section, specify the dollar amount you wish to contribute from each pay period. Ensure that the amount is a whole dollar and meets the minimum requirement.

- In the investment allocation election section, indicate the percentages for the investment options you choose. All percentages should add up to 100%. Use whole numbers only and avoid fractions.

- Read the authorization section carefully and provide your signature along with the date to confirm your consent for the contributions to be deducted from your paycheck.

- Once you have completed all sections of the form, review your entries for accuracy. You can save your changes, download, print, or share the completed form as needed.

Complete your Sip Jhrps form online today to ensure your contributions are processed efficiently.

Your 401(k) will make money or lose money based on the strength of the stocks and mutual funds in which you invest. Your balance is likely to drop when the market drops, depending on what funds you've chosen. Since investments are not insured by the Federal Deposit Insurance Corp.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.