Loading

Get 457(b) Plan Deferred Compensation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 457(b) Plan Deferred Compensation online

This guide provides clear and comprehensive instructions for completing the 457(b) Plan Deferred Compensation payout request form online. By following these steps, users can ensure their information is accurately submitted for processing.

Follow the steps to complete your payout request form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital environment.

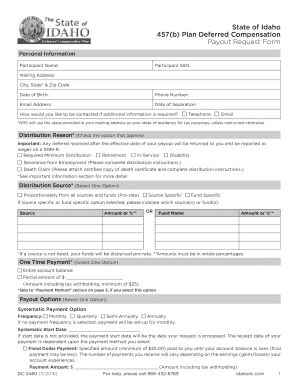

- Complete the personal information section. Enter your participant name, Social Security number, mailing address including city, state, and ZIP code, date of birth, phone number, email address, and date of separation.

- Indicate your preferred method of contact for any additional information by selecting either telephone or email.

- Choose the reason for distribution from the available options such as required minimum distribution, retirement, disability, severance from employment, or death claim. Note that certain options may require additional documentation.

- Select your distribution source. You may choose to withdraw funds proportionately from all sources or specify a particular source or fund by listing the source and the amount or percentage requested.

- Indicate if you prefer a one-time payment and specify whether you wish to withdraw your entire account balance or a partial amount.

- If choosing systematic payments, select the frequency of payments (monthly, quarterly, semi-annually, or annually) and provide the desired start date. You can also choose between fixed dollar payments or fixed period payments based on the balance.

- Complete the payment method section by selecting how you wish to receive your funds: ACH to a bank account or a check by mail. Fill in the necessary financial institution information if choosing direct deposit.

- Address tax withholding preferences by marking desired withholding amounts for federal tax and noting any state tax adjustments, if applicable.

- Sign the certification section, certifying that all information provided is accurate and acknowledging the terms and conditions, including tax implications.

- Return the completed form by faxing it to the designated number or submitting it to Human Resources, ensuring that all sections are clearly filled out.

Complete your 457(b) Plan Deferred Compensation payout request online today to ensure a smooth and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.