Loading

Get Form No 10f

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 10f online

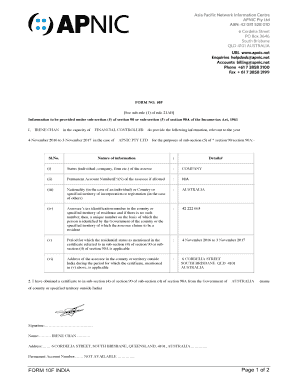

Filling out the Form No 10f is an essential step for individuals and entities seeking to provide relevant information under the Income-tax Act, 1961. This guide will take you through the necessary steps to complete the form accurately and efficiently in an online format.

Follow the steps to complete Form No 10f online.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- In the introductory section, fill in your name and the capacity in which you are submitting the form. For example, enter 'Irene Chan' and 'Financial Controller' as appropriate.

- Indicate the relevant period for which the residential status certificate applies, ensuring accuracy regarding the dates.

- Complete the table by filling in the required information, including the status of the assessee, PAN (if allotted), nationality or country of incorporation, tax identification number, applicable period, and address during the specified period.

- Provide the country name from which you have obtained a residency certificate as mentioned in the relevant sections of the Income-tax Act.

- Review all the information filled in the form for correctness and completeness to ensure it aligns with the residency certificate.

- Finally, sign the form, date it appropriately, and input your address and PAN (if available) before saving the document.

- Once completed, you can save your changes, download the document, print it, or share it as necessary for your requirements.

Start completing your Form No 10f online today for a seamless submission experience.

The purpose of Form 10F is to establish your identity, that you are an Indian citizen, non-resident of India, and pay taxes in the country where you do live. The period of residential status you list on Form 10F should be the same as the period of residential status listed on your tax residency certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.