Loading

Get Irs Form 3881

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 3881 online

Filling out the IRS Form 3881 online can streamline the process of establishing ACH payments for vendor and miscellaneous payments. This guide provides step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the IRS Form 3881 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

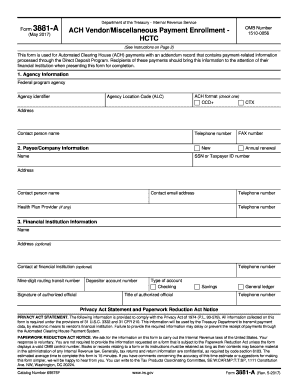

- In the Agency Information section, enter the name of the federal program agency, agency identifier, and agency location code (ALC). Select the appropriate ACH format by checking either CCD+ or CTX. Include the agency's address and the contact person's name along with their telephone number.

- In the Payee/Company Information section, indicate if this is a new enrollment or an annual renewal. Provide the name of the payee or Health Plan Administrator (HPA), their address, Social Security number or Taxpayer ID number, contact person's name, contact email address, and telephone number. If applicable, include the Health Plan Provider's contact number.

- In the Financial Institution Information section, enter the name of the payee's financial institution and, if pertinent, their address. Fill in the contact person's details at the financial institution, including their nine-digit routing transit number and depositor account number. Select whether the type of account is checking or savings, and provide the signature, title, and telephone number of the authorized official from the financial institution.

- After completing all sections of the form, review your entries for accuracy. Make any necessary adjustments before saving your changes. Once everything is correct, you can download, print, or share the completed form as needed.

Start filling out your IRS Form 3881 online today to ensure timely processing of your ACH payments.

IRS refund payments sent electronically through the ACH network are not subject to reclamation. If an RDFI receives a tax refund for a deceased account holder, it is not required to take any further action.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.