Loading

Get Tax Return Questionnaire For Tax Year 2016 - Oa Tax Partners

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Questionnaire For Tax Year 2016 - OA Tax Partners online

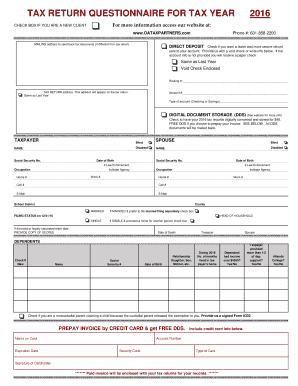

This guide provides clear instructions for users on how to complete the Tax Return Questionnaire for Tax Year 2016 from OA Tax Partners online. It is designed to assist both new and returning clients in effectively navigating through the form's various sections.

Follow the steps to successfully complete the questionnaire.

- Click the ‘Get Form’ button to obtain the Tax Return Questionnaire. This will allow you to access the form in a suitable editor online.

- Begin by checking the box if you are a new client, as this helps the firm with your file management.

- Indicate your preference for direct deposit by checking the appropriate box and filling in your bank account details, including routing and account numbers for faster refunds.

- Fill in information about the taxpayer and spouse, including names, social security numbers, dates of birth, and contact information.

- Select your filing status as of December 31, 2016, by checking the appropriate box, and provide relevant dates if applicable.

- List your dependents. For each dependent, provide their name, social security number, date of birth, and relationship to you, along with any income details related to them.

- Complete the income section carefully, checking corresponding boxes for W-2s, 1099s, and any other income sources, followed by providing the necessary dollar values.

- Fill out sections for deductions and credits, including moving costs, medical expenses, and contributions. Document specific amounts and attach supporting documentation as needed.

- Review all entered information for accuracy and completeness to avoid delays in processing.

- Once completed, save your changes. You can download, print, or share the form as needed by utilizing the options provided in the editor.

Prepare to submit your tax documents online and ensure a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Tax is a compulsory payment imposed on persons and companies to meet the expenditure incurred by the government for common benefit of the people in the country. Was this answer helpful?

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.