Loading

Get Vat101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat101 online

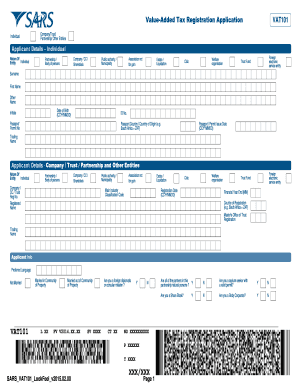

The Vat101 form is essential for individuals and entities registering for value-added tax (VAT) in South Africa. This guide provides a clear, step-by-step walkthrough of how to complete the Vat101 online, ensuring that all required information is gathered accurately.

Follow the steps to successfully complete the Vat101 online.

- Click ‘Get Form’ button to obtain the Vat101 form and open it in the editor.

- Begin by filling out the 'Applicant Details' section, including your surname, first name, date of birth, and identification number. Ensure that your details match the official documents.

- Specify the nature of the entity you are registering as, choosing from options such as company, partnership, or individual. Fill in the registered name and registration number where applicable.

- Provide your contact information, including home, business, and cell phone numbers, as well as your email address. If you do not have a cell phone or email address, mark the appropriate boxes.

- Complete the 'Registered Physical Address' section with your street address details, ensuring accuracy for correspondence.

- If your postal address is different from your physical address, fill out that section. Indicate if this information is the same as above or provide whatever is necessary for the postal address.

- In the 'Bank Accounts' section, declare your South African bank account status and provide the necessary details, such as account type and bank details.

- Indicate your VAT liability date and business activity code. Address whether you expect to exceed taxable supplies of R50,000 in the next 12 months.

- If applicable, complete sections regarding diesel refund options based on your business activities.

- Finally, review your entries for accuracy. Sign the declaration to confirm that the information provided is true and correct. After review, you can save, download, print, or share the Vat101 form as needed.

Complete your Vat101 form online today for a seamless VAT registration experience.

VAT is an abbreviation for the term Value-Added Tax. It is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to register for VAT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.