Loading

Get Form Il 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IL 941 online

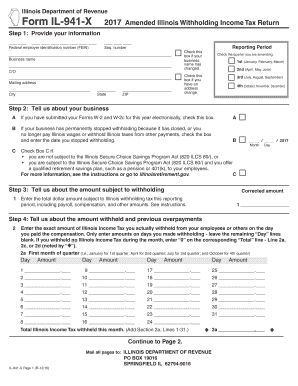

Filling out the Form IL 941 online is a crucial process for businesses to report their Illinois withholding income tax. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Form IL 941 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your information in the designated fields, including your business name, mailing address, and federal employer identification number (FEIN). Make sure to check the appropriate quarter you are amending.

- Indicate if your business name has changed or if you have an address change by selecting the corresponding checkboxes.

- Tell us about your business by checking the box if you have submitted your Forms W-2 and W-2c electronically. Indicate if your business has permanently stopped withholding and provide the date it stopped.

- Enter the total dollar amount subject to Illinois withholding tax for the reporting period in the 'Corrected amount' field.

- For each month in the quarter, enter the exact amount of Illinois Income Tax withheld from employees or others, specifying the amounts for each day you made a withholding.

- Add the total Illinois Income Tax withheld across months and enter that amount in the designated field.

- Proceed to report payments and credits by entering the amount of credits used, withholding payments made, and IDOR-approved credits.

- Calculate the balance by subtracting the total payments from the total amount due, and indicate if there is an overpayment.

- Sign the form and provide any necessary documentation to support your amended return.

- Finally, ensure you save changes, download, print, or share the completed form as required.

Complete your Form IL 941 online and ensure your compliance with Illinois tax regulations.

You can access your federal tax account through a secure login at IRS.gov/account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.