Loading

Get 13614 Nr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 13614 Nr online

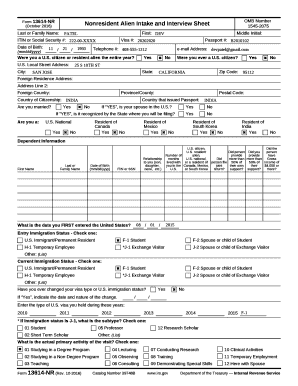

The 13614 Nr form is formulated for nonresident aliens to collect essential information for tax purposes. This guide will provide you with clear and supportive instructions on how to fill out the form correctly and efficiently online.

Follow the steps to fill out the 13614 Nr form online:

- Press the ‘Get Form’ button to access the 13614 Nr form and open it in your selected digital platform.

- Begin by entering your last or family name, first name, and middle initial, if applicable.

- Input your Individual Taxpayer Identification Number (ITIN) or Social Security Number, followed by your date of birth in the format mm/dd/yyyy.

- Fill in your visa number, passport number, and telephone number as required.

- Indicate whether you were a U.S. citizen or resident alien for the entire year by selecting 'Yes' or 'No'.

- Provide your local street address in the U.S., including city, state, and zip code.

- Enter your foreign residence address and country of citizenship.

- Respond to questions regarding your marital status and whether your spouse is in the U.S.

- Complete the dependent information section if applicable by listing each person’s name, date of birth, relationship, and ITIN or SSN.

- Indicate your entry immigration status and current immigration status by marking the appropriate checkbox.

- If applicable, provide details about your academic institution, including its name, address, and director's information.

- Review all entered information for accuracy and completeness.

- At the end of the form, you will have options to save your changes, download, print, or share the completed form.

Complete your 13614 Nr form online today for efficient tax processing!

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.