Loading

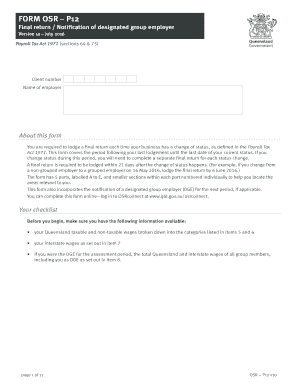

Get Form P12 Final Return /notification Of Designated Group Employer. Payroll Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form P12 Final Return / Notification Of Designated Group Employer. Payroll Tax online

Filing the Form P12 Final Return is essential for businesses experiencing a change of employer status under the Payroll Tax Act 1971. This guide will provide a clear, step-by-step approach to completing the form online, ensuring compliance and accuracy in your payroll tax obligations.

Follow the steps to complete the Form P12 Final Return online.

- Click the ‘Get Form’ button to access the Form P12 and open it in your preferred editor.

- Review and confirm your client details in Part A, including your client number, employer status, and the relevant dates for the return. If any details are incorrect, ensure you contact the relevant office before submission.

- Complete Part B regarding your change of employer status. Answer the questions regarding cessation of employment and any applicable status changes, and provide the necessary details for your new employer status.

- Move to Part C to report the wages. Enter your Queensland taxable and non-taxable wages in the specified categories, ensuring that the total for each section is accurate and reflects whole dollar amounts.

- In Part D, calculate your payroll tax amount using the details you entered in Part C. Ensure to follow the specified calculations to determine your payroll tax liability.

- Complete Part E by signing and providing the name and contact details of the authorized person verifying the information submitted is accurate.

- Finally, save your changes, then download, print, or share the completed form as needed. Ensure that you submit your payment and any necessary documents to the Office of State Revenue.

Complete and submit your Form P12 Final Return online today to ensure compliance with payroll tax regulations.

What is Payroll Tax in QLD? The payroll tax rate in Queensland is 4.75% for employers or groups of employers paying $1.3 million or less in Australian taxable wages. For employers or groups of employers paying more than $6.5 million, the payroll tax rate is 4.95%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.