Loading

Get Form 5564

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5564 online

Filling out Form 5564 can be a straightforward process if you follow the right steps. This guide will provide you with detailed information on how to complete the form effectively and ensure that all necessary fields are correctly filled out.

Follow the steps to fill out Form 5564 online seamlessly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields to complete the form.

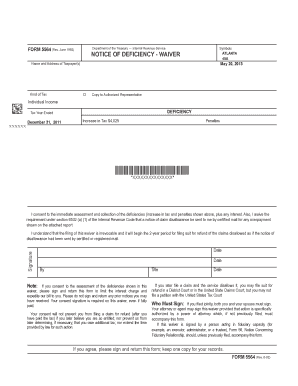

- Begin by filling out the 'Name and Address of Taxpayer(s)' section. Provide accurate contact information to ensure proper identification and communication.

- In the 'Kind of Tax' section, select 'Individual Income' to specify the type of tax relevant to your situation.

- Indicate the 'Tax Year Ended' by entering the appropriate year relevant to the deficiency being addressed.

- Record the ‘Increase in Tax’ amount as specified in your notice. Ensure this figure matches what has been communicated to you.

- If applicable, fill in the 'Penalties' section, if any, that are associated with your tax deficiency.

- In the consent section, affirm your agreement to the immediate assessment of the deficiencies by signing your name and providing the date of signing. Ensure that you understand the implications of signing this waiver.

- Lastly, review all entered information for accuracy before finalizing your form. You can then save your changes, download, print, or share the completed form as needed.

Take action and complete your Form 5564 online today to ensure a smooth process.

It explains the proposed increase or decrease in your tax. Note: The amounts shown as due on the enclosed Form 5564, Notice of Deficiency – Waiver, may not match your previous notice amount due because you can't challenge all items in U.S. Tax Court. Respond to the notice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.