Loading

Get Task Figure The Net Pay

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Task Figure The Net Pay online

This guide provides clear instructions for filling out the Task Figure The Net Pay form online. Understanding how to accurately complete this document is essential for calculating your net pay after deductions, which impacts your financial planning.

Follow the steps to accurately complete the form

- Click the ‘Get Form’ button to download the form and open it for editing.

- Begin by filling out your name in the designated 'NAME' field at the top of the form.

- Enter the current date in the 'DATE' field next to your name.

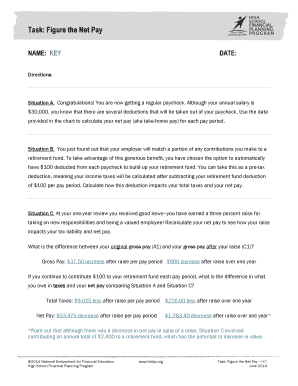

- Review the three situations provided, starting from Situation A, which outlines your regular paycheck scenario.

- For Situation A, input your gross pay of $30,000 in the 'Gross Pay' section. Deduct applicable taxes and benefits as outlined in the chart.

- Move on to Situation B. Record your pre-tax deduction of $100 for retirement funding in the 'Pre-Tax Deduction' field. Calculate the new taxable pay after this deduction.

- In Situation C, record the raise you received and calculate your adjusted gross pay. Enter this new figure into the 'Gross Pay' section and re-calculate your deductions and net pay.

- Ensure all totals, including taxes and deductions, are accurately reflected in the corresponding sections for all three situations.

- After reviewing your entries for accuracy, you may save the changes, download the form, print it, or share it as needed.

Complete your Task Figure The Net Pay form online today and take control of your financial planning.

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Next, divide this number from the annual salary. For example, if an employee has a salary of $50,000 and works 40 hours per week, the hourly rate is $50,000/2,080 (40 x 52) = $24.04.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.