Loading

Get Ira Transfer Form - Nicholas Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Transfer Form - Nicholas Funds online

Completing the IRA Transfer Form - Nicholas Funds online is a straightforward process. This guide provides clear, step-by-step instructions to help users confidently fill out the form and initiate their IRA transfer.

Follow the steps to complete your IRA Transfer Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

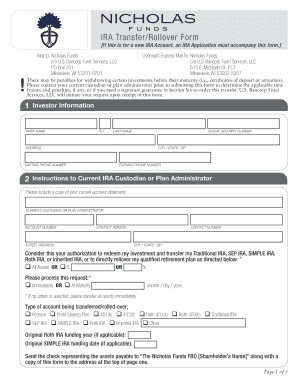

- Begin by filling out Section 1, Investor Information. Provide your first name, middle initial, last name, social security number, address, city, state, zip code, and both daytime and evening phone numbers.

- In Section 2, Instructions to Current IRA Custodian or Plan Administrator, indicate your current custodian or plan administrator, account number, contact person's name, their street address, contact number, and city/state/zip. Include a copy of your current account statement with your submission.

- Select whether you want to transfer all assets or a specific dollar amount or percentage. Also, specify if you want the transfer to be processed immediately or at maturity.

- In the same section, indicate the type of account being transferred. Check the appropriate boxes for Traditional IRA, SEP IRA, SIMPLE IRA, Roth IRA, or any other applicable accounts.

- Complete Section 3, Investment Selection. Indicate if you are opening a new account or transferring to an existing one. Select the Nicholas Funds you wish to include and provide the respective allocation amounts or percentages.

- If you are age 70½ or older, complete Section 4 by checking the appropriate statement regarding required minimum distributions.

- In Section 5, if you are converting from a Traditional IRA to a Roth IRA, indicate your intention and understand the tax implications. You must sign and date this section.

- In Section 6, provide your signature and date, certifying the information. If a signature guarantee is needed, complete that portion as well.

- Finally, in Section 7, be aware that your submission will be accepted by U.S. Bank, NA, as Custodian of your IRA. To finalize, review all filled sections and ensure everything is accurate.

- After completing the form, you can save changes, download, print, or share the form as needed before mailing it to the specified address.

Initiate your IRA transfer process online today by completing your IRA Transfer Form.

An IRA cannot be held jointly by spouses. It can only be held in one individual's name. But one workaround, depending on what you're trying to accomplish, would be to appoint the accountholder's spouse their power of attorney.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.