Loading

Get Ct-1120 Rdc, 2016 Research And Development Expenditures Tax Credit. 2016 Research And Development

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-1120 RDC, 2016 Research And Development Expenditures Tax Credit online

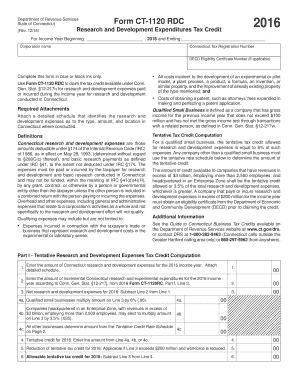

This guide provides comprehensive instructions for completing the CT-1120 RDC form to claim research and development tax credits for the income year 2016. It is designed to support users at all experience levels in navigating the requirements and fields of the form effectively.

Follow the steps to fill out the CT-1120 RDC form accurately.

- Press the ‘Get Form’ button to access the CT-1120 RDC form and open it for editing.

- Provide the corporation name and Connecticut Tax Registration Number in the designated fields. Ensure all entries are in blue or black ink.

- If applicable, enter the DECD Eligibility Certificate Number, as required by your company’s qualifications.

- Fill in the beginning and ending dates of the income year in the format designated on the form.

- In Part I, enter the total amount of Connecticut research and development expenses for the 2016 income year. Prepare and attach a detailed schedule identifying all R&D expenditures.

- Provide the amount of incremental Connecticut research and experimental expenditures in Line 2, as outlined in the instructions.

- Calculate the tentative tax credit using the methods outlined in Lines 4, reducing it if applicable according to Line 5.

- Complete Part II by calculating the allowable tentative tax credit and total Corporation Business Tax liability.

- If you are eligible to exchange the tax credit, follow the application procedures laid out, ensuring all necessary documentation is attached.

- Review the completed form for accuracy, then save your changes, and if necessary, download or print a copy for your records.

Start completing your CT-1120 RDC form online today to ensure you capture all eligible research and development tax credits.

Connecticut also has a 7.50 percent corporate income tax rate. Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes. Connecticut's tax system ranks 47th overall on our 2023 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.