Loading

Get In State Form 43709 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 43709 online

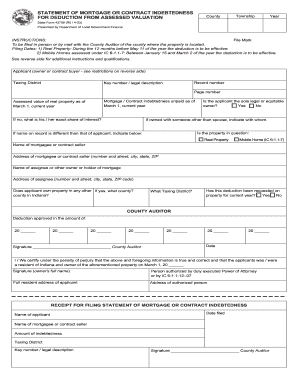

Filling out the IN State Form 43709 online is a crucial step for residents seeking to deduct mortgage or contract indebtedness from their assessed property valuation. This guide will provide you with clear, step-by-step instructions to help you navigate the form efficiently.

Follow the steps to complete your form online:

- Press the ‘Get Form’ button to access the IN State Form 43709 and open it in your chosen online editor.

- Identify the county and township where your property is located and fill in the appropriate fields.

- Enter the year relevant to your deduction request in the designated section.

- Provide your name as the applicant, indicating whether you are the owner or contract buyer.

- Fill in your taxing district and include the raw assessment details including your record and key number or legal description.

- Input the mortgage or contract indebtedness that remains unpaid as of March 1 of the current year.

- State the assessed value of your real property as of March 1 of the current year.

- Indicate your exact share of interest if applicable.

- Specify whether you are the sole legal or equitable owner of the property by selecting 'Yes' or 'No'.

- If you own the property jointly, indicate with whom you share ownership.

- Select whether the property in question is Real Property or a Mobile Home.

- If the name on the record differs from yours, indicate the correct name in the space provided.

- Fill in the name and address of the mortgagee or contract seller, including city, state, and ZIP code.

- Provide the name and address of the assignee or other owner of the mortgage, including postal details.

- State if you own property in any other county in Indiana and specify the county if applicable.

- Choose the taxation district associated with the additional property.

- Answer whether this deduction has previously been requested for the current year.

- Leave the section for the County Auditor blank as it is reserved for their approval and signature.

- Complete the certification statement affirming that the information provided is true and sign your full name.

- If applicable, provide the address of any person authorized by a Power of Attorney.

- After completing all fields, you can save your changes, download the form, print it, or share it as necessary.

Begin filling out your IN State Form 43709 online today to ensure you meet the filing requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out Form 8829 requires detailing your home office expenses, including direct and indirect costs. You need to break down the expenses into specific categories and compute your total deductions. Incorporating IN State Form 43709 while filling out Form 8829 can help you maintain accuracy throughout the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.