Loading

Get Form Ta-1, Rev 2016, Transient Accommodations Tax Return. Form 2016 - Handwritable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form TA-1, Rev 2016, Transient Accommodations Tax Return online

Filling out the Form TA-1, Rev 2016, is an essential process for those involved in transient accommodations in Hawaii. This guide offers clear and supportive instructions to help you accurately complete the form and fulfill your tax obligations.

Follow the steps to successfully complete your Form TA-1 online.

- Press the ‘Get Form’ button to access the form and open it in the designated editor.

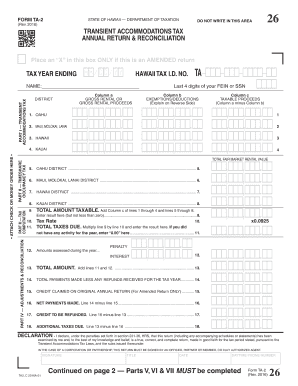

- Enter the tax year ending in the format mm/dd/yy at the top of the form.

- Provide your Hawaii Tax I.D. number in the designated field.

- Fill in your name in the specified section.

- Proceed to Part I and enter the gross rental proceeds from each district into Column a for Oahu, Maui/Molokai/Lanai, Hawaii, and Kauai.

- In Column b of each district, list any exemptions or deductions, providing explanations on the reverse side if necessary.

- Calculate the taxable proceeds by subtracting Column b from Column a in Column c for each district.

- Add the totals from Column c for lines 1 through 4 and lines 5 through 8 to determine the total amount taxable.

- Multiply the taxable amount by the appropriate tax rate to find the total taxes due and enter the result.

- Complete any adjustments for penalties or interest in the subsequent sections.

- Review all your entries for accuracy and make sure you have signed the declaration.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your Form TA-1 online today to ensure compliance and simplify your tax reporting process.

The penalty for failure to file a return on time is calculated at 5% per month, or part of a month, on the unpaid tax up to a maximum of 25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.