Loading

Get Arizona Form Az-8879. E-file Signature Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form AZ-8879. E-file Signature Authorization online

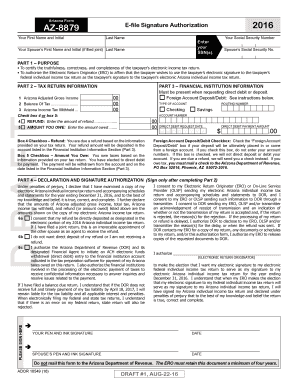

Filling out the Arizona Form AZ-8879 is essential for certifying the accuracy of your electronic income tax return and authorizing direct interaction with the Arizona Department of Revenue. This guide provides a step-by-step approach to assist you in completing the form confidently and accurately.

Follow the steps to complete the Arizona Form AZ-8879.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your first name and initial, followed by your last name. This identifies you as the taxpayer.

- Input your Social Security Number (SSN) in the designated field to verify your identity.

- If filing jointly, complete the section for your spouse’s first name, initial, and last name, along with their Social Security Number.

- In Part 1, review the purpose statement to ensure you understand the authorization you are providing.

- Proceed to Part 2 and enter your Arizona adjusted gross income, balance of tax, and Arizona income tax withheld.

- Select either the refund option or the amount you owe by checking the appropriate box and entering the corresponding amount.

- Fill in the financial institution information in Part 3, including account type, routing number, and account number for direct deposits or debits.

- For foreign account transactions, check the corresponding box and skip entering account numbers.

- Complete Part 4 by reviewing the declaration and signing where indicated. Ensure all information is accurate before signing.

- Finalize your process by saving the changes made to the form. You can download, print, or share the completed document as needed.

Complete your Arizona Form AZ-8879 online now and ensure timely filing of your electronic income tax return.

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.