Loading

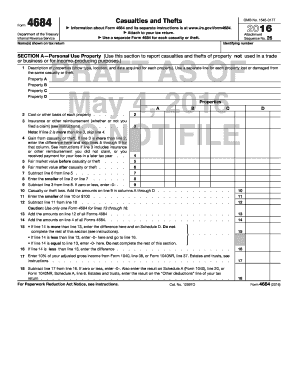

Get Form 4684 Casualties And Thefts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4684 Casualties And Thefts online

Filling out Form 4684, which addresses casualties and thefts, can seem challenging, but with the right guidance, you'll find it manageable. This guide provides user-friendly steps to help you complete the form online effectively.

Follow the steps to fill out Form 4684 accurately.

- Click 'Get Form' button to access the form and open it in your preferred editing platform.

- Begin by filling in the name(s) shown on your tax return at the top of the form. Ensure this information matches your official tax documents.

- In Section A, provide a description of each property affected by the casualty or theft. Include details such as the type of property, location, and the date you acquired each property.

- Detail the cost or other basis for each property in the designated field. This reflects what you paid for the property or its worth.

- Report any insurance or other reimbursements you received related to these properties, noting whether you filed a claim or not.

- If your insurance reimbursement exceeds your total property costs, note the gain from the casualty or theft, and skip the subsequent calculation lines in this column.

- Calculate the fair market value of your property before and after the casualty or theft, then subtract the latter from the former.

- Enter the lesser figure of your costs or the loss amount discovered from the previous step.

- Subtract the amount received from insurance from this smaller figure, ensuring you enter zero or the amount derived.

- Accumulate the loss amounts reported to get the total for line 10 and continue with the necessary deductions and calculations outlined.

- Once all sections of the form are completed accurately, ensure to save your changes, download a copy, and print or share as needed for your records.

Complete your Form 4684 online today to ensure a smooth filing process!

A casualty loss occurs when your property is lost or damaged due to an earthquake, fire, flood, or similar event that is sudden, unexpected, or unusual. You usually qualify for a casualty loss deduction for tax purposes when insurance or other reimbursements do not repay you for damage to your property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.