Loading

Get Form 2441

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2441 online

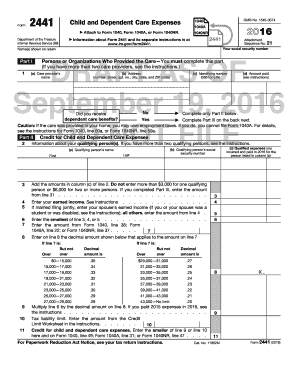

Filling out the Form 2441 is essential for claiming child and dependent care expenses on your tax return. This guide provides clear, step-by-step instructions to help you complete the form online with ease.

Follow the steps to complete your Form 2441 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In Part I, provide information about the persons or organizations who provided the care. Complete each field, including the care provider’s name, address, identifying number, and the amount paid.

- Indicate whether you received dependent care benefits by checking ‘Yes’ or ‘No’. If you answered ‘Yes’, proceed to Part III.

- In Part II, list information about your qualifying person(s). You will need to enter their names and social security numbers.

- Add the amounts from the column of qualified expenses you incurred and paid, ensuring that you do not exceed the maximum limits.

- Enter your earned income and that of your spouse if filing jointly. This information is critical for calculating the credit.

- Once all necessary fields are completed, proceed to calculate the credit by multiplying the appropriate amounts as instructed.

- Complete Part III if you received dependent care benefits. Input the total amount of benefits and any other applicable amounts as instructed.

- After verifying all information for accuracy, save your changes. You can then download, print, or share the completed Form 2441.

Complete your Form 2441 online today for a smooth tax filing experience.

If you hire someone to care for a dependent or your disabled spouse, and you report income from employment or self-employment on your tax return, you may be able to take the credit for child and dependent care expenses on Form 2441.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.