Loading

Get 8453c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8453c online

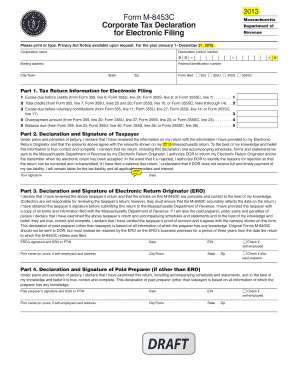

Filling out the Form M-8453C is a crucial step in the electronic filing of corporate taxes in Massachusetts. This guide will provide you with a clear, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the 8453c for electronic filing

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin filling out the corporate name and mailing address in the specified fields at the top of the form. Be sure to include the city/town, state, and zip code accurately.

- Enter the federal identification number in the designated field. This number is essential for your corporation's identity in relation to federal tax purposes.

- Proceed to Part 1 and accurately report the tax return information for electronic filing. Fill in the excise due before credits, total credits, excise due before voluntary contributions, overpayment amount, and balance due as outlined by referencing your previous forms (355, 355U, 355S, or 355SC).

- In Part 2, sign and date the declaration, confirming that you have reviewed the information provided and authorize the electronic return originator to submit your return on your behalf.

- If applicable, continue to Part 3 to complete the declaration and signature of the electronic return originator. Ensure the signature, SSN or PTIN, date, EIN, and firm name or self-employed status are accurately filled out.

- Move to Part 4 if there is a paid preparer other than the electronic return originator. Complete the necessary declaration and signatures, including the paid preparer's signature, SSN or PTIN, date, EIN, firm name, and address.

- After completing the form, review all entries for accuracy. Users can save the changes, download a copy, print, or share the completed form as desired.

Start filing your documents online now for a smooth and efficient process.

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.