Loading

Get Form 8944

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8944 online

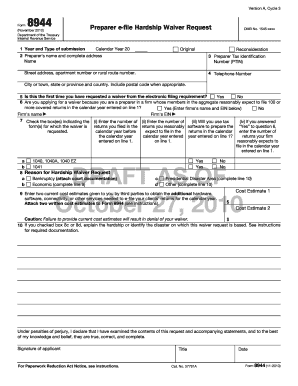

Filling out Form 8944 is necessary for specified tax return preparers requesting a hardship waiver from the electronic filing requirement. This guide offers clear, step-by-step instructions to help users understand and complete the form online.

Follow the steps to fill out Form 8944 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the calendar year for which you are requesting the waiver in Line 1, and indicate whether this is an original submission or a reconsideration by checking the appropriate box.

- Fill in your name and complete address in Line 2.

- Provide your Preparer Tax Identification Number (PTIN) in Line 3.

- Include a telephone number in Line 4 for inquiries related to your request.

- In Line 5, indicate whether this is your first hardship waiver request by selecting ‘Yes’ or ‘No’.

- For Line 6, if you are part of a firm that expects to file 100 or more covered returns, check ‘Yes’ and provide the firm's name and Employer Identification Number (EIN); otherwise, check ‘No’.

- Check the box(es) for the form(s) regarding which you are requesting the waiver in Line 7.

- In Line 8, select the reason for your hardship waiver request; you may need to provide additional documentation depending on your selection.

- For Line 9, if applicable, enter two cost estimates from third parties regarding obtaining the necessary resources to e-file your clients' returns.

- Complete Line 10 if you checked boxes 8c or 8d, providing an explanation of your hardship.

- Finally, review the form for completeness, then save changes, download, print, or share the form as necessary.

Start filling out your Form 8944 online today to ensure your hardship request is submitted promptly.

If a taxpayer opts to paper file a tax return, or the return is unable to be e-filed, the preparer must include a Form 8948, Preparer Explanation for Not Filing Electronically, with the paper filed submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.