Loading

Get Form It-20s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-20S online

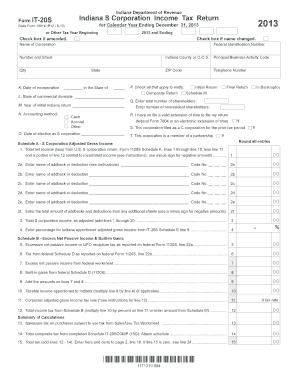

Filling out the Form IT-20S is essential for Indiana S corporations to report their income tax accurately. This guide provides you with clear, step-by-step instructions to help you complete the form efficiently and correctly.

Follow the steps to fill out the Form IT-20S online:

- Press the ‘Get Form’ button to access the form and open it in your selected online environment.

- Begin by entering the name of your corporation in the designated field. If there has been a name change, check the corresponding box.

- Input the federal identification number of your corporation.

- Provide the number and street address, along with the Indiana county or out-of-state location.

- Fill in the principal business activity code and the city, followed by the ZIP code.

- Enter your telephone number for contact purposes.

- Indicate the date of incorporation and the state where the incorporation took place.

- Check the box to specify the state of commercial domicile of the corporation.

- Select all relevant options that apply to your entity by checking the corresponding boxes.

- Input the total number of shareholders as well as the number of nonresident shareholders.

- Select your accounting method from the options provided: Cash, Accrual, or Other.

- If applicable, check the box to indicate that you have a valid extension of time to file your return.

- If the corporation filed as a C corporation for the prior tax period, check the respective box.

- Enter the date of election as an S corporation.

- Complete the areas related to excessive net passive income and built-in gains, referring to federal forms as necessary.

- Summarize the calculations based on your tax liabilities by filling in the totals and relevant amounts as they appear in the sections.

- Lastly, review all entries for accuracy, then save your changes, and choose to download, print, or share the completed form.

Start filling out your Form IT-20S online today to ensure timely and accurate tax reporting.

A general rule of thumb is to file Indiana state taxes if your income is $1,000 or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.