Loading

Get Form 8027 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8027 Instructions online

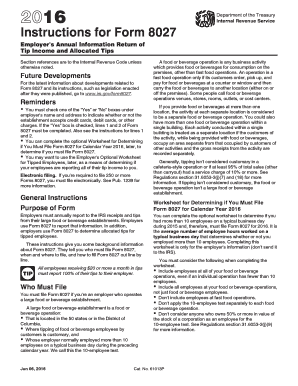

Navigating the Form 8027 can be a straightforward process with the right guidance. This guide will provide you with clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out the Form 8027 Instructions online.

- Click ‘Get Form’ button to access the Form 8027 and open it in your preferred online editor.

- Begin by entering the employer's name and address at the designated fields, ensuring to include the employer identification number (EIN). Remember to format foreign addresses correctly without abbreviations.

- Indicate the establishment number for each large food or beverage establishment. Assign a unique five-digit number to each one and ensure consistency for future filings.

- Complete the section defining the type of establishment only by checking the appropriate box that describes your operation, whether it's evening meals only or otherwise.

- Report the total charged tips for the calendar year by entering the amount shown on charge receipts on line 1.

- On line 2, enter the total charge receipts that include charged tips. Ensure to exclude any nonallocable receipts from this total.

- Proceed to fill out lines regarding service charges, directly tipped employees, and allocate tips as necessary. Follow the directions carefully to ensure accurate reporting.

- Review all entries for accuracy and completeness before submitting the form. Once confirmed, you can save changes, download your form, or share it as necessary.

Ensure that your documents are accurate and complete by filing your Form 8027 online today.

Those penalties include a late fee ranging from $50 to $290 per form, depending on how late you file. In addition, if you don't correctly fill out Form 8027, you can't accurately fill out employees' W-2 forms. The same penalty amounts apply to each W-2 issued incorrectly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.