Loading

Get 8615

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8615 online

Filling out Form 8615 correctly is essential for determining the tax liability of certain children with unearned income. This guide provides a step-by-step approach to completing the form online, ensuring users of all experience levels can navigate it confidently.

Follow the steps to ensure accurate completion of Form 8615.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

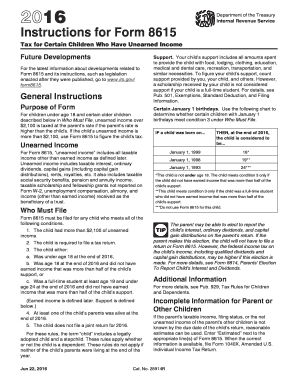

- Review the purpose of Form 8615, which is used for the taxation of children under 18 or certain older children with unearned income exceeding $2,100. Understand who is required to file this form by checking the eligibility prerequisites outlined within.

- Complete Lines A and B by entering the name and Social Security number of the parent as instructed, based on whether the parents filed jointly or separately.

- Determine the child's unearned income, which includes interest, dividends, and other non-earned income sources, and input this information on Line 1 of the form.

- Calculate the amount of support provided by the parent, child, and others to confirm whether the total exceeds the limits set forth, as this impacts who must file.

- Use the Child's Unearned Income Worksheet to accurately calculate any adjustments needed before entering them on Form 8615, following each line's instructions carefully.

- Complete the required calculations to ascertain the tax amount, utilizing the Tax Table or Tax Computation Worksheet, depending on your situation.

- Double-check all entries for accuracy and completeness before proceeding to save changes, download, print, or share the completed form.

Complete your tax documents online today to ensure a smooth filing experience.

Who's required to file Form 8615? For 2022, Form 8615 needs to be filed if all of the following conditions apply: The child has more than $2,300 in unearned income. The child is required to file a tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.