Loading

Get 2016, Publication Or-40-ext, Instructions For Automatic Extension Of Time To File Oregon Individual

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016, Publication OR-40-EXT, Instructions For Automatic Extension Of Time To File Oregon Individual online

This guide provides clear and supportive instructions for users on how to effectively complete the 2016 Publication OR-40-EXT form for an automatic extension of time to file the Oregon Individual Income Tax Return. Following these steps will ensure a smooth and accurate filing process.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the OR-40-EXT form, which you will need to fill out for the automatic extension.

- Begin by entering your personal information. This includes your name, social security number, and your current mailing address. Ensure all details are accurate to avoid any delays.

- Next, indicate the tax year for which you are requesting the extension. For this form, the relevant year is 2016. Fill in the beginning and end dates of the tax year.

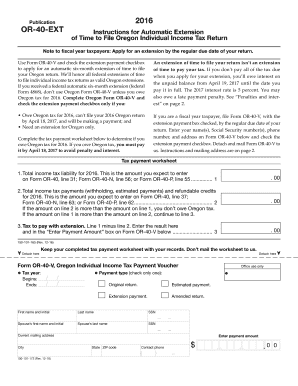

- Use the tax payment worksheet provided to calculate your total income tax liability for 2016. This figure reflects the total amount you expect to pay in taxes for the year.

- Input your total income tax payments, including any withholding and estimated payments made throughout the year. This will help determine if you owe any taxes.

- Subtract your total income tax payments from your total income tax liability to find out the tax amount due with your extension application. Enter this amount in the designated section.

- Select the appropriate payment type by checking the corresponding box (e.g., extension payment, estimated payment, amended return). Make sure to choose only one option.

- Finally, review all filled information for accuracy. Once confirmed, you can save your changes, download the completed form, print it, and prepare to submit it as instructed.

Complete your Oregon tax forms online today to ensure an efficient filing process.

More In Forms and Instructions Form 8868 is used by an exempt organization to request an automatic 6-month extension of time to file its return. Also, the trustee of a trust required to file Form 1041-A or Form 5227 must use Form 8868 to request an extension of time to file those returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.