Loading

Get Form Pa V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form PA V online

Filling out the Form PA V online is a straightforward process that requires attention to detail and accuracy. This guide provides you with step-by-step instructions to complete the form efficiently, ensuring compliance with all necessary requirements.

Follow the steps to complete the Form PA V online

- Press the ‘Get Form’ button to access the PA V form and open it in your editor.

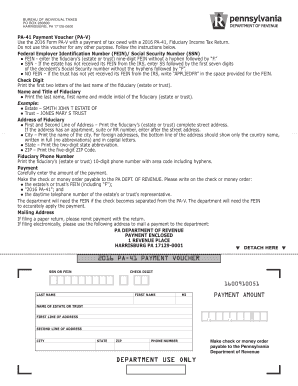

- In the FEIN/SSN section, enter the fiduciary’s nine-digit FEIN without a hyphen and append 'F'. If the estate lacks an FEIN, write 'SS' followed by the first seven digits of the decedent’s SSN without hyphens, followed by 'F'. If no FEIN has been received yet, indicate 'APPLIEDFR'.

- For the Check Digit, print the first two letters of the fiduciary's last name.

- In the Name and Title of Fiduciary section, clearly print the last name, first name, and middle initial of the fiduciary. For estates, format as 'LAST NAME FIRST NAME ESTATE OF', and for trusts, use 'LAST NAME FIRST NAME TRUST'.

- Fill out the Address of Fiduciary: On the first and second lines, provide the complete street address. If applicable, include apartment, suite, or RR number. Fill in the city, state abbreviation, and five-digit ZIP code. For foreign addresses, list only the country name in full and capital letters on the last line.

- Enter the fiduciary's 10-digit phone number with area code in the Fiduciary Phone Number section.

- In the Payment section, carefully input the amount to be paid. Make checks or money orders payable to the PA Department of Revenue, including the estate's or trust's FEIN, '2016 PA-41', and a daytime phone number.

- If filing a paper return, include this payment with the return. If filing electronically, send the payment to the PA Department of Revenue at the specified address.

Take the first step towards completing your documents online today!

Claiming Tax Forgiveness To claim tax forgiveness, the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40, Individual Income Tax return. On PA-40 Schedule SP, the claimant or claimants must: Determine the amount of Pennsylvania-taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.