Loading

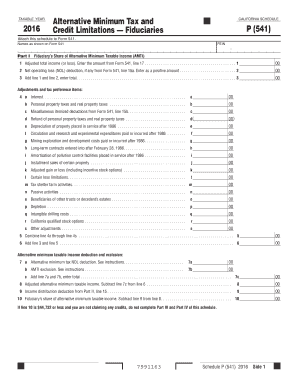

Get 2016 Schedule P (541) -- Alternative Minimum Tax And Credit Limitations -- Fiduciaries. 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2016 Schedule P (541) -- Alternative Minimum Tax And Credit Limitations -- Fiduciaries. 2016 online

The 2016 Schedule P (541) is an essential form for fiduciaries managing alternative minimum tax and credit limitations in California. This guide provides a clear, step-by-step approach to filling out the form effectively online, ensuring accuracy and compliance with tax regulations.

Follow the steps to fill out the 2016 Schedule P (541) online.

- Press the ‘Get Form’ button to access the form and display it in your online editor.

- Begin by entering your names exactly as shown on Form 541 at the top of Schedule P.

- Next, provide the Federal Employer Identification Number (FEIN), ensuring that it matches the corresponding Form 541.

- In Part I, record the adjusted total income or loss from Form 541, line 17 on line 1 of Schedule P.

- For line 2, enter the net operating loss deduction, if applicable, retrieved from Form 541, line 15a.

- Calculate the total for line 3 by adding line 1 and line 2, and enter the sum.

- Complete adjustments and tax preference items from lines 4a through 4s, inputting any relevant amounts.

- Sum all adjustments in line 5 and add this total to line 3 on line 6.

- Subtract line 7c from line 6 to determine the adjusted alternative minimum taxable income, entering the result on line 8.

- Proceed to lines 9 and 10 to record the income distribution deduction and calculate the fiduciary’s share of alternative minimum taxable income.

- In Part II, enter figures for adjusted alternative minimum taxable income and other relevant inputs to determine the distributable net alternative minimum taxable income (DNAMTI).

- Continue with Part III to compute the tentative minimum tax and alternative minimum tax based on previous calculations and any relevant exemptions.

- Finally, fill out Part IV to indicate any credits that may reduce your tentative minimum tax, ensuring all required credit forms are attached.

- Upon completion, save the changes, download, print, or share the form as necessary.

Start completing your documents online today for a smoother filing experience.

Exclusion items are only the following AMT adjustments and preferences: certain itemized deductions (including any investment interest expense reported on Schedule E), certain tax-exempt interest, depletion, the section 1202 exclusion, the standard deduction, and any other adjustments related to exclusion items.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.