Loading

Get Ha Form N311 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ha Form N311 Instructions online

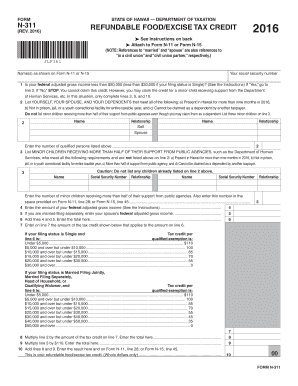

Filling out the Ha Form N311 online is a straightforward process designed to help users claim a refundable food and excise tax credit. This guide provides step-by-step instructions to make the process clear and accessible.

Follow the steps to fill out the Ha Form N311 Instructions online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your name as it appears on Form N-11 or N-15 in the designated field. Ensure accuracy to avoid processing delays.

- Input your social security number in the provided area. This is necessary for identification purposes.

- Address the eligibility question regarding your federal adjusted gross income. If your income is below the specified threshold, proceed to the next question. If not, you are not eligible for this credit.

- List yourself, your partner, and your dependents who meet the residency criteria in Hawaii for the specified tax year. Ensure to note any qualifying factors such as not being claimed by another taxpayer.

- If applicable, list any minor children receiving more than half of their support from public agencies separately, ensuring to follow the instructions regarding their eligibility.

- Fill in your federal adjusted gross income as directed. If you are married and filing separately, also include your partner’s income.

- Calculate the tax credit based on your adjusted gross income and filing status as outlined in the form. Refer to the correct section for your specific scenario.

- Multiply the number of qualifying individuals and children by the corresponding tax credit amounts. Make sure to review the calculations for accuracy.

- Finally, combine the total amounts and record the final result. Make sure to enter the final figure in the designated lines on Form N-11 or N-15.

- Review all entries on the form before saving changes, downloading, printing, or sharing the completed form as required.

Get started and complete your forms online today to ensure your tax credits are claimed accurately.

Mailing Tips Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS® blue collection box or at a Postal location that has a pickup time before the deadline.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.