Loading

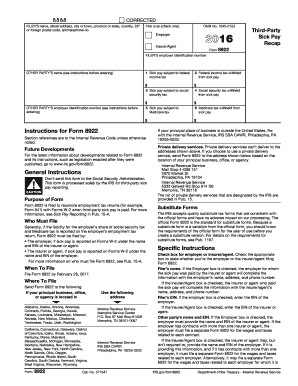

Get 2016 Form 8922. Third-party Sick Pay Recap

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Form 8922. Third-Party Sick Pay Recap online

Filling out the 2016 Form 8922, used for recapping third-party sick pay, requires careful attention to detail. This guide will help you navigate each section of the form effectively to ensure proper reporting.

Follow the steps to fill out the 2016 Form 8922 correctly

- Click ‘Get Form’ button to obtain the form and open it in a suitable document management platform.

- Identify the filer’s name, street address, city or town, state, country, ZIP code, and telephone number. This information should reflect the entity completing the form.

- Check the appropriate box to declare if the filer is the employer or the insurer/agent.

- Enter the filer’s employer identification number (EIN); ensure this corresponds with the selected entity type.

- In section 1, report the sick pay amount that is subject to federal income tax.

- In section 2, document the total federal income tax withheld from the sick pay reported.

- Proceed to section 3 and indicate the sick pay amount subject to social security tax.

- In section 4, report the social security tax that has been withheld from the sick pay.

- Section 5 requires reporting of the sick pay subject to Medicare tax.

- Finally, in section 6, state the total Medicare tax withheld from the sick pay.

- Provide the other party's name and their EIN, if applicable, based on who is filing the form.

- Review all entered data for accuracy and completeness.

- Once satisfied, save changes to the form, and download, print, or share it as necessary.

Complete your documents online today for easy and efficient management.

ing to Publication 15-A, Employer's Supplemental Tax Guide, third party sick pay wages should not be included in Box 1 of the W2; they should only be reported in Box 12. If the W-2 was completed incorrectly, a corrected Form W-2 will need to be issued to the taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.