Loading

Get Form 593e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 593e online

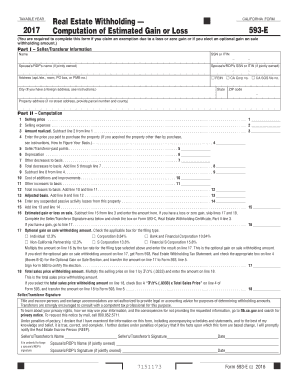

Filling out Form 593e is essential for individuals claiming an exemption due to a loss, zero gain, or electing optional gain on sale withholding amounts. This guide provides clear and step-by-step instructions to assist you in completing the form online with ease.

Follow the steps to fill out Form 593e online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Input your personal details in Part I. Include your name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and your address. Ensure you provide information for your partner or spouse if applicable.

- In Part II, begin the computation section by entering the selling price of the property in the specified field. This figure represents the total amount received from the sale.

- Next, enter your selling expenses in the corresponding field. This may include costs associated with the sale such as agent fees and closing costs.

- Calculate the amount realized by subtracting the selling expenses from the selling price. Enter this result in the next line.

- Record the purchase price of the property in the designated field. If you acquired the property through means other than purchase, refer to the instructions provided.

- If applicable, input any points paid by the seller/transferor in the next field.

- Then, list any depreciation that has been applied to the property in the specified line.

- Include other decreases to basis if relevant, and calculate total decreases to basis by adding the appropriate values.

- Subtract the total decreases from the property's purchase price to obtain the adjusted basis.

- In the following sections, enter costs for any additions or improvements made to the property, along with any other increases to basis.

- Calculate the estimated gain or loss on sale by following the instructions laid out in the form.

- Complete the seller/transferor signature area, ensuring all required signatures have been provided.

- Once all sections are filled out, save your changes, and you may choose to download, print, or share the completed form as needed.

Complete your Form 593e online today and manage your real estate withholding efficiently.

California law requires withholding when a person (an individual, business entity, trust, or estate) sells California real property unless the seller qualifies for an exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.