Loading

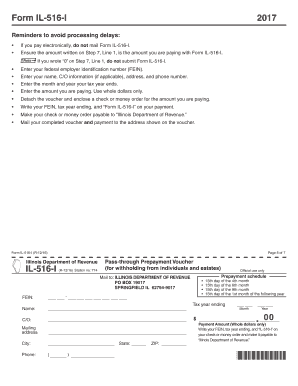

Get 2017 Form Il-516-i And Form Il-516-b, Pass-through Prepayment Vouchers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2017 Form IL-516-I And Form IL-516-B, Pass-through Prepayment Vouchers online

Filling out the 2017 Form IL-516-I and Form IL-516-B is a straightforward process designed for individuals and estates making prepayments. This guide provides clear, step-by-step instructions to help users navigate the forms online effectively.

Follow the steps to complete the forms accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your federal employer identification number (FEIN) at the specified section of the form.

- Provide your full name, and if applicable, include C/O information in the designated field. Next, input your complete mailing address and phone number.

- Specify the month and year when your tax year ends. This information is critical for accurate processing.

- Clearly state the amount you are paying on the form, ensuring to use whole dollars only.

- Detach the voucher section from the form. Prepare a check or money order for the payment amount you've indicated, and ensure it contains your FEIN, tax year ending, and ‘Form IL-516-I’ written on the payment.

- Make your check or money order payable to ‘Illinois Department of Revenue’.

- Finally, mail the completed voucher along with your payment to the address provided on the voucher, ensuring that it is sent to the Illinois Department of Revenue, PO Box 19017, Springfield, IL 62794-9017.

Complete your forms online today to ensure timely processing and avoid delays.

Illinois also has a 9.50 percent corporate income tax rate. Illinois has a 6.25 percent state sales tax rate, a 4.75 percent max local sales tax rate, and an average combined state and local sales tax rate of 8.82 percent. Illinois's tax system ranks 36th overall on our 2023 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.