Loading

Get Ct 641

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 641 online

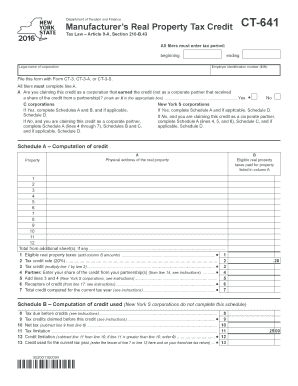

The Ct 641 form facilitates the application for the Manufacturer’s Real Property Tax Credit under New York Tax Law. This guide will provide clear and supportive instructions on filling out the form online, ensuring that all users can complete it accurately.

Follow the steps to successfully fill out the Ct 641 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax period by providing the beginning and ending dates where indicated on the form.

- Fill in the legal name of the corporation and the employer identification number (EIN).

- Complete line A, indicating whether you are claiming the credit as a corporation that earned the credit. Mark an X in the appropriate box for either Yes or No.

- If Yes, complete Schedule A and, if applicable, Schedule D for further details on property and taxes. If claiming as a corporate partner (No), complete the appropriate sections as instructed.

- In Schedule A, list the physical address of the real property and the eligible real property taxes paid. Add any additional sheets if necessary.

- Calculate the total credit by following the instructions and formulas provided, ensuring accuracy in adding and multiplying the correct amounts.

- If you are a New York S corporation, skip Schedule B and calculate any partnership-related information needed in Schedule C.

- In Schedule D, if applicable, provide information on any recaptured credit. Calculate using the details specified for past tax years.

- Review all sections to ensure completeness and accuracy before finalizing your submission.

- After completing the form, save your changes, download a copy for your records, and print or share the form as required.

Submit your Ct 641 form online today to ensure your tax credit is processed.

To qualify for the property tax relief credit you must meet all of the following conditions: a) You must be sixty-five (65) years of age or older and/or disabled. b) You must have been domiciled in Rhode Island for the entire calendar year 2021. c) Your household income must have been $30,000.00 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.