Loading

Get Form Or Cppr 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form Or Cppr 2019 online

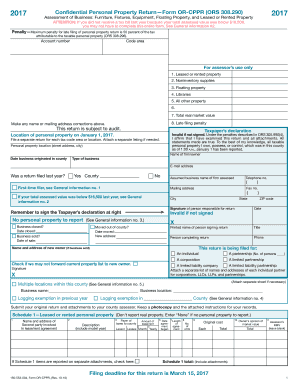

Filling out the Form Or Cppr 2019 online is an essential task for individuals and businesses reporting personal property. This guide is designed to walk you through each section of the form, providing clear and supportive instructions to ensure a smooth filing process.

Follow the steps to fill out the Form Or Cppr 2019 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Identify your account number and ensure it is correctly entered at the top of the form. This number is crucial for processing your return.

- Provide your name, mailing address, and any necessary corrections. Make sure to format your address correctly for accurate delivery.

- Indicate your business status including your type of business, e-mail address, and contact information such as telephone and fax numbers.

- Review the section regarding previous filings. Check 'Yes' or 'No' regarding whether a return was filed last year, and provide details if applicable.

- Fill in the location of the personal property as of January 1, including street address, city, state, and ZIP code.

- Complete the schedules for various categories of personal property, including leased or rented property, noninventory supplies, floating property, libraries, and all other taxable property. Attach separate lists if necessary.

- Sign the Taxpayer’s declaration. Ensure that this signature is provided, as the return is invalid without it.

- After completing all fields, review the form for accuracy. Make any necessary corrections and save your changes.

- Download, print, or share the form as needed. Ensure to submit your original return and attachments to your county assessor.

Start completing your Form Or Cppr 2019 online today to ensure your personal property is reported accurately.

What is more common is for states to have a homestead exemption up to a specific dollar amount or area of land. The Oregon homestead exemption is $40,000 for an individual and $50,000 for a husband and wife filing jointly. Debtors should inquire into their state's laws regarding homestead exemptions before filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.