Loading

Get Form 512-s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 512-S online

Filling out the Form 512-S online can seem daunting, but with the right guidance, you can complete it easily. This guide will walk you through each section of the form to ensure you provide accurate and comprehensive information.

Follow the steps to successfully complete your Form 512-S online.

- Press the ‘Get Form’ button to obtain the form and access it for online completion.

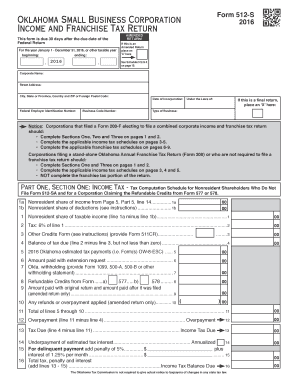

- In the first section, enter your corporate name and street address along with your city, state, province, country, and ZIP or foreign postal code. Make sure to include your Federal Employer Identification Number and Business Code Number.

- Indicate the date of incorporation and specify under which laws your corporation is established. If this submission is a final return, mark the corresponding checkbox.

- In the next section, provide the type of business and ensure you carefully follow the instructions regarding combined corporate income and franchise tax filings, if applicable.

- Complete Part One, Section One, where you will compute income tax for nonresident shareholders, including sections for income, deductions, and tax due. Pay close attention to the necessary calculations.

- Proceed to Section Two to calculate the franchise tax. Use the figures provided in prior sections to complete this part accurately.

- In Section Three, combine the totals from your income tax and franchise tax calculations. Specify if there is a payment due or an overpayment to be refunded.

- If applicable, attach the necessary additional forms such as the 512-S-SUP for extra shareholder details and provide any required signatures from an officer and preparer.

- Review all entered information for accuracy and completeness before finalizing the form. You can then save changes, download, print, or share the file as needed.

Begin completing the Form 512-S online today to ensure your submission is accurate and on time.

Each partner having Oklahoma source income sufficient to make a return, shall make such return as required by law. Partnerships filing Federal Form 1065-B will file Form 514. The taxable year and method of accounting shall be the same as the taxable year and method of accounting used for federal income tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.