Loading

Get Form It 201

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-201 online

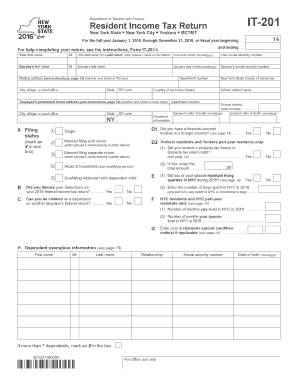

Completing the Form IT-201 online is a straightforward process that enables New York state residents to file their income tax returns efficiently. This guide offers step-by-step instructions to assist you in accurately filling out each section of the form.

Follow the steps to complete the Form IT-201 online:

- Press the ‘Get Form’ button to access the Form IT-201 and open it in the editing interface.

- Begin by entering your personal information, including your first name, middle initial, last name, date of birth, and social security number. If you are filing a joint return, ensure that you also include your spouse's information in the respective fields.

- Next, indicate your mailing address. Fill in the apartment number, street address, city or village, state, ZIP code, and country if applicable.

- Mark your filing status by selecting one of the designated options (Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er)). Ensure you check the box corresponding to your situation.

- Continue to the section regarding exemptions and dependency information. Complete the information for any dependents and indicate if you can be claimed as a dependent by another taxpayer.

- In the subsequent sections, accurately report your income, deductions, and credits as specified. Ensure to follow the section instructions on where to place figures for taxable interest, ordinary dividends, and other income types.

- After completing the income section, fill in any adjustments that apply, such as state or local tax adjustments, deductions, and exemptions.

- Review the tax computation area, where you will calculate your New York state taxes based on the taxable income reported. Complete all necessary calculations, ensuring to follow the subtotals associated with New York City or Yonkers taxes, if applicable.

- Once all sections are filled out, validate that all required fields are completed and double-check the entered data for accuracy.

- Finally, you can save your changes, download the completed form, print it, or share it using the provided options to submit it as needed.

File your documents online efficiently and ensure compliance with your income tax obligations.

It means the IRS has determined you can't afford to pay the debt at this time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.