Loading

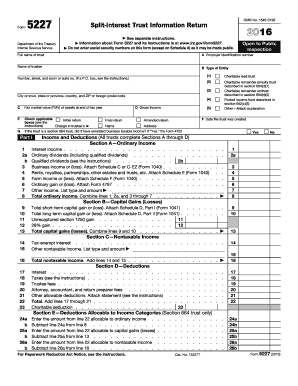

Get 2016 Form 5227. Split-interest Trust Information Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Form 5227. Split-Interest Trust Information Return online

Filling out the 2016 Form 5227, which is the Split-Interest Trust Information Return, is essential for trusts that have both charitable and non-charitable beneficiaries. This guide provides clear, step-by-step instructions tailored to help users, regardless of their legal experience, complete the form accurately and efficiently online.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Identify and enter the full name of the trust in the designated section. This is critical for accurate record-keeping.

- Provide the employer identification number (EIN) of the trust. Ensure that this number is correctly entered to avoid processing delays.

- Fill in the name of the trustee and their contact information. Use the designated fields for a complete address.

- Select the type of entity that the trust is by checking the appropriate box (e.g., charitable lead trust, charitable remainder trust, etc.).

- Report the fair market value (FMV) of the assets at the end of the tax year in the specified section.

- Indicate whether this is the initial return, amendment, or final return by checking the relevant boxes.

- Complete Part I, which involves entering income and deductions. Make sure to fill out each section carefully based on the trust’s financial records.

- Finish by checking all information entered for accuracy. Once confirmed, you can save your progress, download, print, or share the completed form as needed.

Complete your 2016 Form 5227 online to ensure compliance and support your trust's obligations.

A split-interest trust that under its terms is to continue to hold assets for charitable beneficiaries after the noncharitable interest expires rather than distributing them is allowed a reasonable period of time for settlement before being treated as a charitable trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.