Loading

Get Wisconsin Schedule U

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Schedule U online

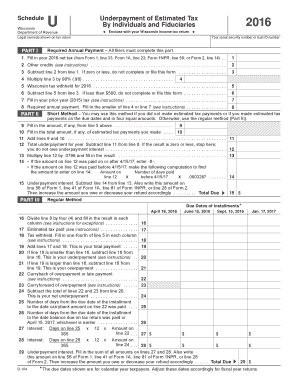

The Wisconsin Schedule U is a vital document for individuals and fiduciaries who need to report the underpayment of estimated tax. Filling it out online can simplify the process, allowing for accuracy and efficiency in tax reporting.

Follow the steps to successfully complete the Wisconsin Schedule U online.

- Press the ‘Get Form’ button to access the Wisconsin Schedule U form and open it in your editor.

- Begin by entering the legal name(s) as shown on your tax return in the appropriate field.

- Provide your social security number or trust ID number in the designated section.

- Complete Part I by filling in your 2016 net tax. This amount can be located on specific lines of your previous tax forms.

- List any other credits applicable to your situation in the provided field.

- Subtract the credits from your net tax to find the necessary annual payment.

- Proceed to multiply the result by 90% to determine the payment amount.

- Note the Wisconsin tax withheld for the year and enter it in the correct field.

- If applicable, subtract the withheld tax from your calculated payment.

- Fill in any additional required information following the prompts in Part II and III as directed, focusing on estimated tax payments and any underpayment calculations.

- Once all relevant sections are complete, review your entries for accuracy.

- You can then save your changes, download, print, or share the completed form as needed.

Complete your Wisconsin Schedule U online to ensure accurate tax reporting and compliance.

Use this form for a prior year return or if you need more information on your current year tax return. If filed electronically, most refunds are issued in less than three weeks. Filing a paper return could delay your refund. Our strong fraud and error safeguards could delay some refunds up to 12 weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.