Loading

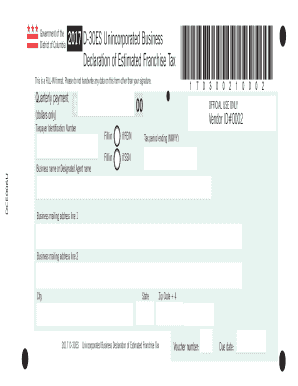

Get 48826 D-30es 0002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 48826 D-30ES 0002 online

Filling out the 48826 D-30ES 0002 form online can be a straightforward process if you follow the proper steps. This guide will provide clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Taxpayer Identification Number (TIN) in the designated field. If you are using a Federal Employer Identification Number (FEIN), fill in that number. Alternatively, if you are using a Social Security Number (SSN), make sure to enter it accordingly.

- Next, provide the name of the business or the name of the designated agent in the respective field. Ensure that the name matches any official documentation.

- Indicate the tax period ending date in the designated MMYY format. This information is essential for tax purposes and helps ensure that your form is processed for the correct period.

- Fill in your business mailing address completely, starting with line 1 and, if necessary, using line 2. Include all relevant details, such as street address, city, state, and ZIP code + 4.

- Enter the dollar amount for your quarterly payment in the appropriate field provided. Ensure that you input only numerical values without any symbols.

- Complete any additional required fields as indicated on the form, ensuring that all information is accurate and complete.

- Once you have filled out all sections and verified the accuracy of your information, you can save changes, download, print, or share the form as needed.

Start filling out your 48826 D-30ES 0002 form online today for a smooth and efficient process.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.