Loading

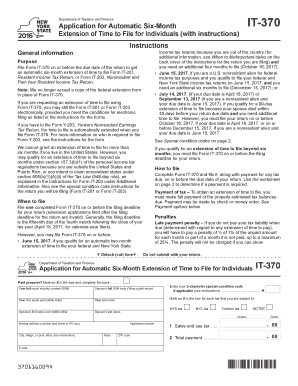

Get Form It-370:2016:application For Automatic Six-month Extension Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-370:2016: Application for Automatic Six-Month Extension of Time to File online

Filling out the Form IT-370 is an important step for individuals needing a six-month extension to file their income tax returns. This guide will provide clear, step-by-step instructions to help you complete this form online with ease.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the preferred online editor.

- In the first section, enter your full name and, if applicable, your spouse's full name if filing jointly. Ensure you include the complete social security numbers for both parties.

- Provide your mailing address, city, state, and ZIP code. Ensure accuracy to avoid any issues with communication regarding your application.

- If applicable, enter your special condition code in the designated field. This is necessary if seeking any additional extensions due to specific circumstances.

- Indicate the taxes you are subject to by marking an 'X' in the appropriate boxes (New York State tax, New York City tax, or Yonkers tax).

- Complete the payment section by calculating any tax payments that may need to accompany your extension request. Use the worksheet provided in the form instructions to determine if a payment is due.

- Review your completed form thoroughly for any errors or omissions. Make sure all sections are filled out accurately.

- Finally, save your changes and download the completed form. You have the option to print or share the form as needed, or submit it online if that option is available.

Complete your Form IT-370 online today to ensure you receive your automatic extension.

General Guideline #2 – SEND in the same amount you paid when you owed LAST YEAR with your last year's tax return (paid last year with your Extension for your 1040 Tax Return for the year before).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.