Loading

Get Form 8880 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8880 2016 online

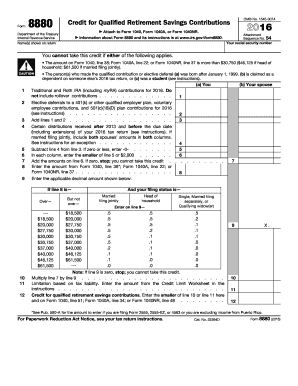

Form 8880 allows users to claim a credit for qualified retirement savings contributions. This guide provides detailed instructions on how to fill out the form online, ensuring a smooth and accurate submission process.

Follow the steps to fill out Form 8880 2016 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your name as shown on your tax return in the designated field at the top of the form. Make sure the spelling is accurate.

- Input your social security number where prompted. This information is crucial for your tax submission.

- Review the eligibility criteria for the credit. Ensure that neither of the disqualifying conditions mentioned applies to you or your spouse.

- Fill in the contributions made to traditional and Roth IRAs for 2016 in line 1. Remember not to include rollover contributions.

- In line 2, report any elective deferrals to retirement plans such as a 401(k). Reference the instructions for any specific guidance regarding contributions.

- Calculate the total of lines 1 and 2 and enter the amount in line 4.

- If applicable, input any distributions received after 2013 in line 5. Follow the instructions closely for any exceptions.

- On line 6, subtract the value in line 4 from line 3. If the result is zero or a negative number, enter '0'.

- Enter the smaller amount between line 5 and $2,000 in line 7 for both you and your spouse.

- Sum the amounts from line 7 for both columns and enter in line 8. If this total is zero, you are not eligible for the credit.

- In line 9, select and enter the applicable decimal amount based on the income thresholds provided.

- Multiply line 7 by line 9 and record the result in line 10, providing the calculated credit amount.

- Complete the form by referencing the Credit Limit Worksheet for line 11, and enter the smaller amount between line 10 and line 11 on line 12.

- Finally, save changes to your completed Form 8880 online, and ensure you have options to download, print, or share the document as needed.

Take action today and complete your Form 8880 online!

Eligibility. have adjusted gross income in 2022 under: $68,000 if married filing jointly. $51,000 if filing as head of household.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.