Loading

Get Form 8879

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8879 online

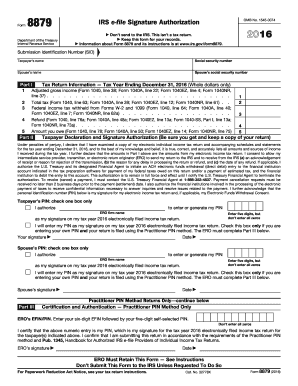

Form 8879 is the IRS e-file signature authorization needed for electronic filing of tax returns. This guide provides clear instructions on how to complete this form online to ensure successful submission.

Follow the steps to fill out Form 8879 with ease.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter the taxpayer's name and social security number in the designated fields. Ensure all information is accurate to avoid processing errors.

- If applicable, input the spouse's name and social security number. This section is only necessary for filers who are married and filing jointly.

- In Part I, input the adjusted gross income from the appropriate line of the tax return. This number is crucial for tax calculations.

- Continue with the total tax amount and the federal income tax withheld amounts in the subsequent fields. Always use whole dollars for these entries.

- Provide the refund amount and the amount owed, if applicable. These figures should correspond to your tax return.

- In Part II, confirm the taxpayer declaration. This section requires you to verify the correctness of the information provided.

- Input your personal identification number (PIN) as a signature for your electronic return. Select the appropriate option regarding who will generate this PIN.

- Complete the spouse’s signature section if filing jointly, following the same PIN entry procedure.

- For practitioner PIN method returns, ensure all mandated information regarding ERO's EFIN/PIN and signature is filled out correctly.

- Once all sections are completed, save changes, download, print, or share the form as needed.

Start filling out your Form 8879 online today to ensure your tax return is processed smoothly.

Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.