Loading

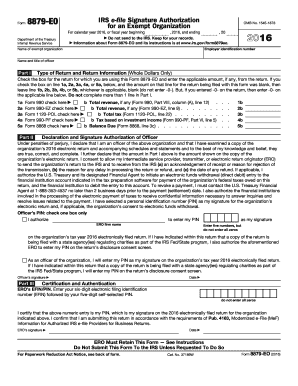

Get 2016 Form 8879-eo. Irs E-file Signature Authorization For An Exempt Organization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Form 8879-EO. IRS E-file Signature Authorization For An Exempt Organization online

Completing the 2016 Form 8879-EO is essential for exempt organizations to authorize electronic filing of their tax return. This guide provides clear, step-by-step instructions to help users fill out the form accurately.

Follow the steps to successfully complete and submit your form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter the name of the exempt organization and its employer identification number in the designated fields.

- In Part I, indicate the type of return you are filing by checking the appropriate box. Enter any applicable amount from the return in the space provided.

- Ensure you only complete one line in Part I to avoid confusion; if the amount is zero, enter '0' in the appropriate line.

- In Part II, read the declaration statement attentively, confirming that you are an officer of the organization and that the information is true and complete.

- Provide your personal identification number (PIN) by selecting the relevant authorization option, then entering your chosen five digits, ensuring that not all zeros are entered.

- Sign and date the form as the authorized officer of the organization.

- In Part III, if applicable, enter your electronic filing identification number (EFIN) and your five-digit self-selected PIN, ensuring compliance with submission requirements.

- Finally, review all information for accuracy before saving your changes, downloading a copy for your records, or printing the form if necessary.

Complete your documents online with confidence, ensuring seamless submission and compliance.

A partner or member or PR and an electronic return originator (ERO) use Form 8879-PE when the partner or member or PR wants to use a personal identification number (PIN) to electronically sign a partnership's electronic return of partnership income or AAR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.