Loading

Get Rev 802

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 802 online

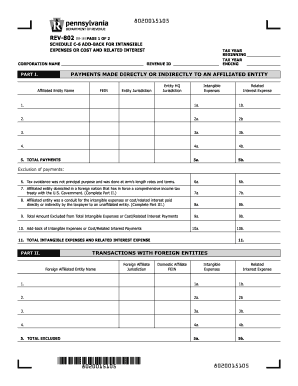

The Rev 802 is an important form used for the Schedule C-6 add-back for intangible expenses or costs and related interest. Filling out this form accurately is essential to comply with tax regulations and ensure proper record-keeping.

Follow the steps to complete the Rev 802 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online platform.

- Enter the tax year beginning and ending dates in the format MMDDYYYY. Ensure you do not include any dashes or slashes in these fields.

- Provide the corporation's name and revenue ID, ensuring all entries are in uppercase letters.

- In Part I, input the affiliated entity's name, FEIN, jurisdiction, and headquarters jurisdiction. Fill in the intangible expenses and related interest expense for each affiliated entity listed.

- Complete section 5 by calculating the total payments made directly or indirectly to affiliated entities. Record these amounts in the provided fields.

- In the subsequent fields, confirm that the tax avoidance was not the principal purpose for these payments and ensure they were made at arm's length rates and terms.

- Fill out information related to foreign entities as required in Part II, following the same procedures as in Part I.

- In Part III, list unaffiliated entities. For each entity, include the necessary details about intangible expenses and related interest expenses, ensuring accurate calculations of total payments and allocations.

- Review the entire form for accuracy. Use the whole dollars only rule for all monetary entries and double-check that no non-numeric symbols are used.

- Save your changes, and either download, print, or share the form as needed, ensuring you keep a copy for your records.

Complete your Rev 802 form online today to ensure compliance and accuracy.

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.